Loanbase connects you with thousands of lenders, instantly sends your deal to those you choose, and delivers key mortgage insights—so you can focus on closing deals, not chasing them.

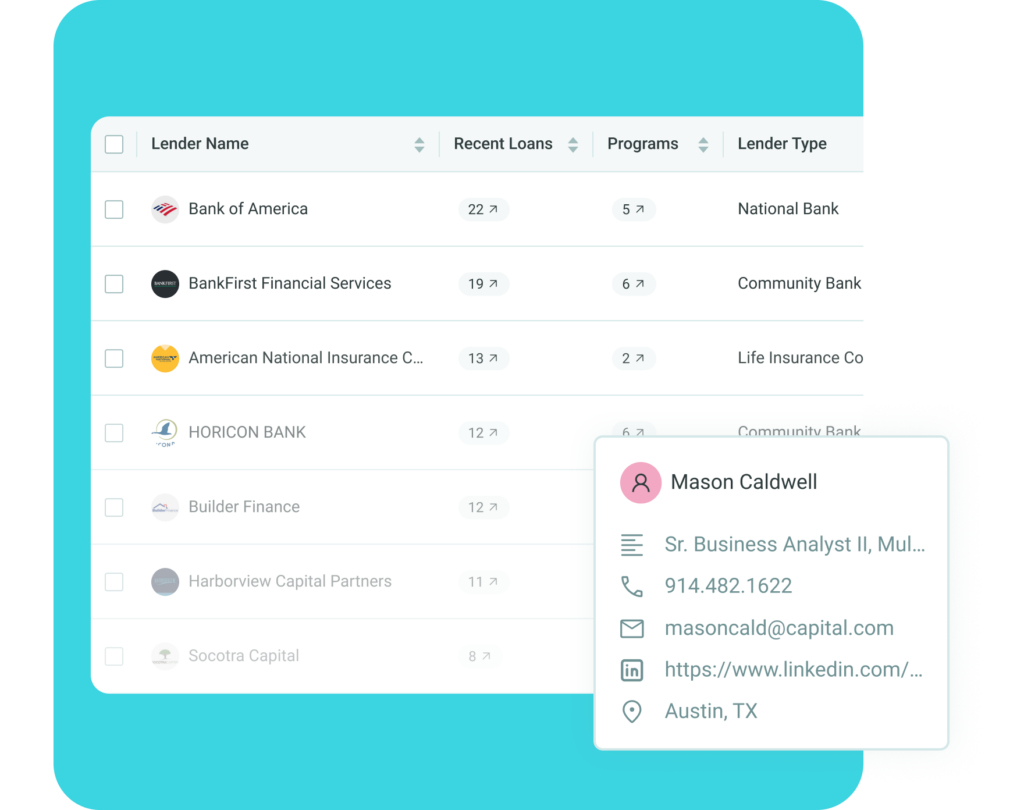

Loanbase connects you to 25,000 lenders across all asset types—helping you find the right lenders at the right time to close your deal.

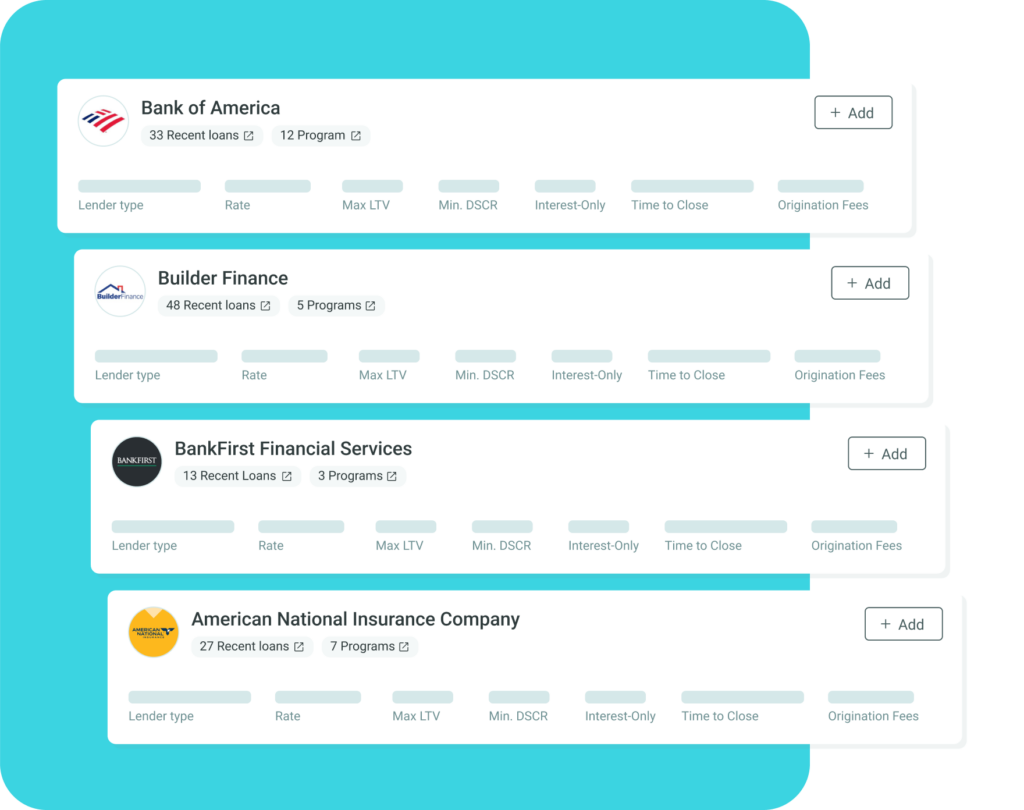

Get real-time, indicative quotes with a click. No waiting, no guessing—just the information you need, when you need it, to make faster decisions.

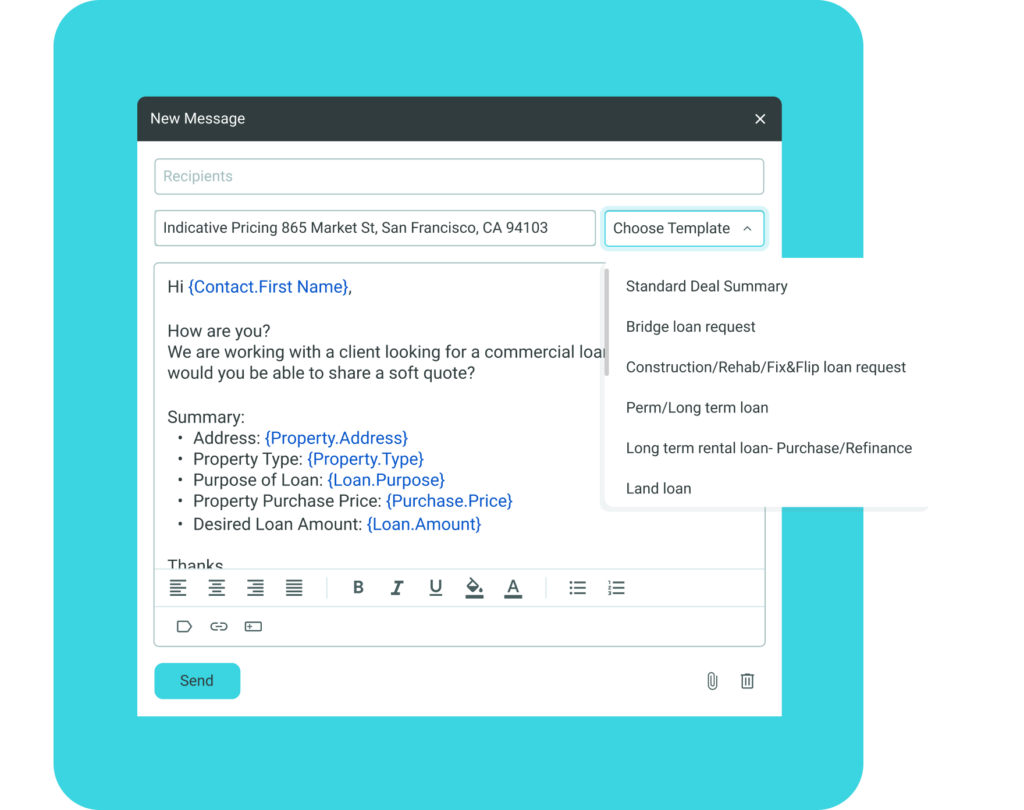

Let automation handle the busy work. With Loanbase, your emails go out automatically to the lenders you choose, while you focus on what really matters—getting the deal done.

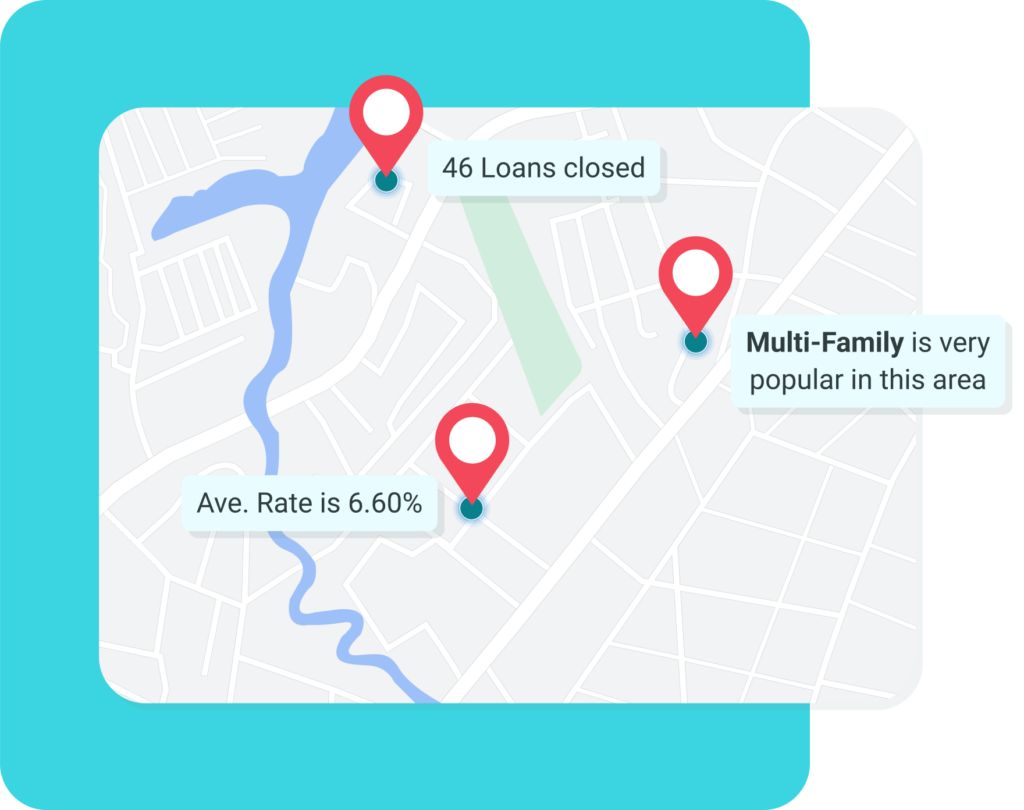

Who’s active in your market? Loanbase shows you detailed mortgage insights, which lender is active, what loans have been closed, at what rates, terms and where. Know who’s closing deals where it matters most.

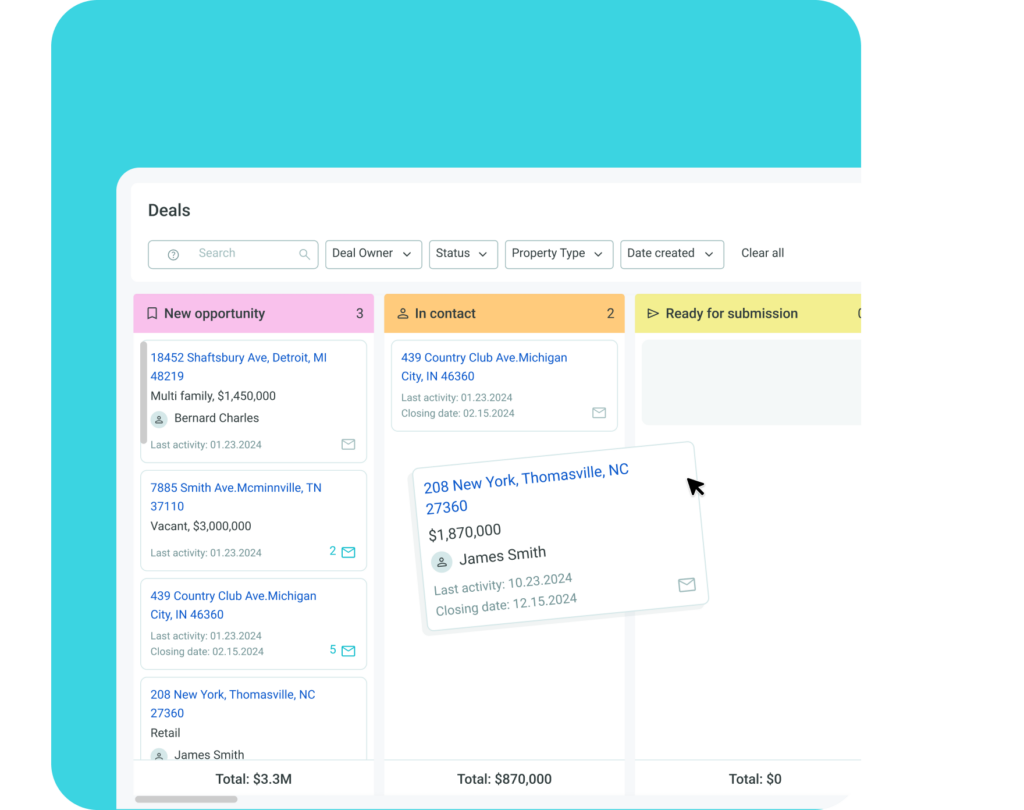

Keep every deal organized in one place. Loanbase tracks your progress, so you never lose sight of a step, helping you close each deal with confidence and efficiency.

© 2025 LoanBase Technologies Inc. All Rights Reserved.