Retail Investment Properties

Retail commercial properties are properties that are commercially zoned and used for business purposes only. These properties cannot manufacture goods; instead, they can only sell

December 6, 2021

Retail commercial properties are properties that are commercially zoned and used for business purposes only. These properties cannot manufacture goods; instead, they can only sell

Office commercial properties (also known as office CREs) are used specifically for conducting business and workplace-related activities. Some businesses that occupy office commercial real estate

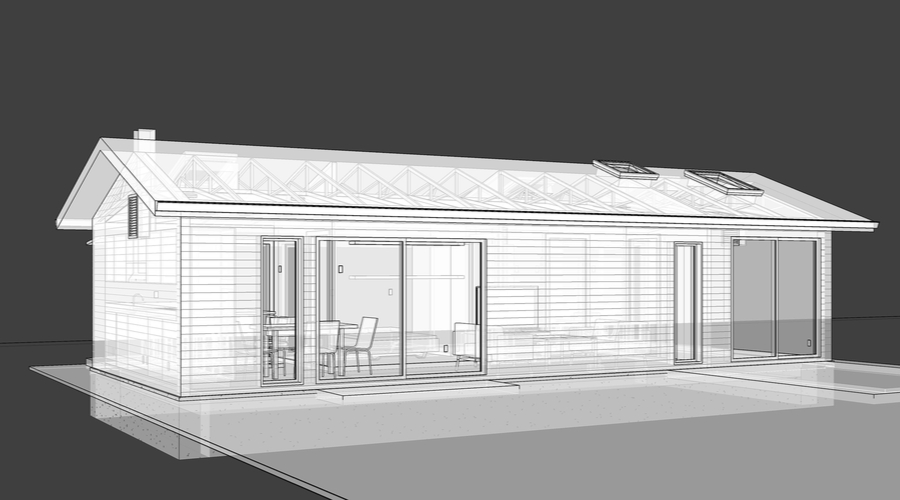

What is an ADU? Accessory dwelling units are secondary dwelling units built on the same lot as your larger, primary residence. They’re a great way

© 2025 LoanBase Technologies Inc. All Rights Reserved.