Rental Property Tax Deductions: a Comprehensive Guide

One of the best ways to get the most out of your rental property is to deduct everything you can during tax season. Successful rental

Carey Chesney

One of the best ways to get the most out of your rental property is to deduct everything you can during tax season. Successful rental

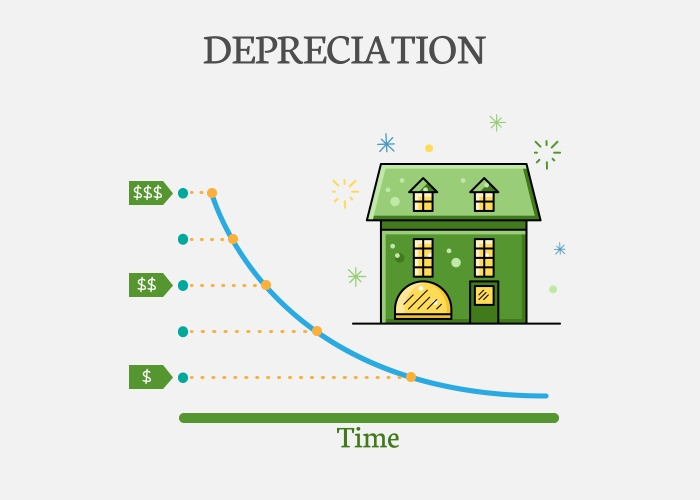

If you own a rental property, your mind should be constantly geared toward getting the most money possible out of your investment. The monthly cash

Creating a limited liability company ( LLC) for your rental property business can provide you with many benefits, including saving some money during tax time.

Build-to-rent single-family homes gaining popularity. Millions of Americans, especially younger generations, are unable or unwilling to purchase their own homes. Reasons may include a lack

If you’ve watched any HGTV lately, you’ve probably heard the term fix and flip more than a few times. Watching people purchase, improve, and then

If you have a hard money loan on your investment property, you are most likely paying a higher interest rate than you planned for in

© 2025 LoanBase Technologies Inc. All Rights Reserved.