What is a ground-up construction project?

Ground-up construction projects are when a real estate developers or investor develops a brand new property on undeveloped land.

Short term

Ground-up Construction loans can range from 12 to 24 months. The term of the loan can be structured to fit the project timeline. Ground up construction loans can be rolled into long term financing at completion.

Covered Costs

The funds provided in a ground-up construction loans are to be used solely for the hard and soft costs of the development project. Lenders can structure the loan to include the acquisition of the land if the developer doesn’t already own the property.

Down Payments

Ground-up construction loans require a minimum down payment of 20% which can be the sum of cash and equity already invested into the deal. The lender will require proof of equity invested into the project.

Who should seek out a ground up construction loan?

- A developer who already owns the raw / undeveloped who is looking to develop a structure

- Experienced investors who are looking to hire a development team to develop a property

- Developers who need immediate access to funds to successfully complete a construction project

Due Diligence

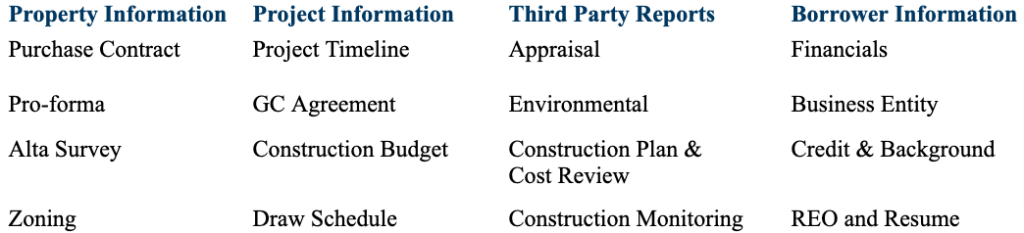

The developer / investor will need to provide property information, project information, order third party reports and provide borrower information. Below are some of the documents a lender will request:

Construction Draw Information

The requirements for a construction draw schedule depends on the lender. Borrowers, investors, and developers need to be prepared to provide the required documentation before and during the loan. During the loan lenders will require proof of all fees reported prior to each draw. This requirement also benefits the lender as they will know exactly how much cash to have on hand prior to a draw. Draw setback can put construction projects on pause. Borrowers should ask the lender if commitment funding is available as this allows borrowers to avoid paying interest on construction funds until they are drawn.