What are small balance loans?

Freddie Mac’s Small Balance loans (SBL Program) are a great way to finance your apartment or multifamily property.

Because these loans range in size from $1-7.5M, they’re perfect for the small borrower market. Plus they offer flexibility with fixed-rate, floating-rate, and interest-only loan options.

In this piece, we’ll explain everything you need to know about Freddie Mac’s SBL Program.

Let’s dive in.

The Basics

Before taking out a SBL from Freddie Mac, you need to know the basic terms:

- Loan Amount: $1-7.5M in all markets

The size, rate, and terms of your loan depend on the market your property is located in.

Freddie Mac divides markets by 4 tiers: Top, Standard, Small, or Very Small. Top Markets like NYC and LA county will be subject to different terms than Standard Markets like Phoenix. Freddie Mac designates tiers based on rental population size, determined by the Census Bureau. See a detailed breakdown of each market here.

Freddie Mac also divides markets by 5 regions: Western, South Central, North Central, Southeast, and Northeast. Interest rates will vary slightly depending on your region.

- Unit Limitations

Freddie Mac places limitations on your loan amount based on the number of units in your multifamily property.

For up to 100 units, your loan must be greater than $6M and less than or equal to $7.5M.

- Loan Purpose

You can only take out a Freddie Mac SBL for an acquisition or refinance.

- Loan Terms – Hybrid ARM or Fixed Rate

Hybrid ARM: 20-year term with an initial fixed-rate period of 5, 7, or 10 years.

Fixed: 5, 7, or 10-year loan term.

- Amortization – up to 30 years

- Interest-only loans

For interest-only loans, Freddie Mac offers both partial-term and full-term loans.

- Prepayments

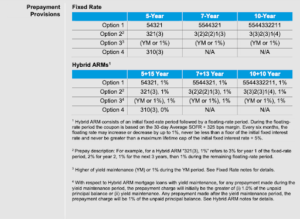

Freddie Mac offers declining schedules and yield maintenance for all loan types. Check out this chart from the Freddie Mac website for more details on each prepayment provision.

- Eligible borrowers/entities

Freddie Mac’s SBLs are available to numerous types of eligible borrowers:

- Limited partnerships

- LLCs

- Single Asset Entity

- Special Purpose Entities

- Tenancy in common with up to 5 unrelated members

- Irrevocable trusts with an individual guarantor

- Recourse

SBLs are non-recourse loans. Standard carveout provisions are also required—this gives Freddie Mac the legal ability to go after your personal assets if you foreclose on the loan.

- Subordinate debt

Subordinate debt is not permitted for SBLs.

- Net Worth + Liquidity

To be eligible for a SBL from Freddie Mac, you must have a minimum net worth equal to the loan amount. You must also possess minimum liquidity equal to 9 months of the principal and interest.

Find out if your property is eligible for a SBL

Not all multifamily properties are eligible for a SBL from Freddie Mac. Keep reading to find out if your property qualifies!

- Eligible Properties

Multifamily properties with 5+ residential units are eligible for a SBL from Freddie Mac.

Specifically, this includes:

- Properties with tax abatements

- Age-restricted properties with no resident services

- Properties with space for certain commercial (non-residential uses)

- Properties with tenant-based housing vouchers

- Low-Income Housing Tax Credit (LIHTC) properties with Land Use Restriction Agreements (LURAs) that are either in the final 24 months of the initial compliance period or the extended use period (investor must have exited)

- Properties with local rent subsidies for 10% or fewer units where the subsidy is not contingent on the owners’ initial or ongoing certification of tenant eligibility

- Properties with certain regulatory agreements that impose income and/or rent restrictions, provided all related funds have been disbursed

- Ineligible Properties

Some types of multifamily properties are ineligible for a SBL from Freddie Mac. These include:

- Senior housing with senior care services

- Student housing (+25% concentration)

- Military housing (+25% concentration)

- Properties with project-based housing assistance payment contracts—including project-based Section 8 HAP contracts

- LIHTC properties with LURAs in compliance years 1-12

- Historic Tax Credit (HTC) properties with a master lease structure

- Tax-exempt bonds Interest Reduction Payments (IRPs)

- Occupancy

To be eligible for a Freddie Mac SBL, your property must be stabilized with a minimum 90% physical occupancy

- Replacement Reserves

Replacement reserves are funds used to finance the periodic maintenance of a building and offset wear and tear. It’s important to include this line item in your annual budget.

Freddie Mac determines underwritten replacement reserves by a rating established in the streamlined Physical Risk Report.

- Escrows

For SBL deals with an LTV ratio of 65% or less, Freddie Mac defers real estate tax escrows. Insurance escrows and replacement reserve escrows are also deferred with a SBL.

SBL Loan Terms

If you take out a Freddie Mac SBL Loan, it’s important to understand the difference in loan terms between markets.

Your LTV and DSCR requirements will vary based on which of the 4 market tiers your property falls under. See the table below for more info:

| Minimum Amortizing DCR | Maximum LTV | |

| Top Markets | 1.20x | 80% |

| Standard Markets | 1.25x | 80% |

| Small Markets | 1.30x | 75% |

| Very Small Markets | 1.40x | 75% |

- Partial-Term Interest-Only (IO) Options

Freddie Mac Part-Term Interest-Only (IO) Options vary based on market.

Top and Standard SBL Markets:

- 1 year on a 5-year term

- 2 years for a 7-year term

- 3 years for a 10-year term

Small and Very Small SBL Markets:

- 0 years on a 5-year term

- 1 year for a 7-year term

- 2 years for a 10-year term

- Full-term Interest-Only (IO) Adjustments

Freddie Mac offers two options based on market size.

Top & Standard SBL Markets:

- 0.15x added to the baseline

- 65% Maximum LTV

Small & Very Small SBL Markets:

- 0.10x

- 60% Maximum LTV

Final Thoughts

Freddie Mac’s Small Balance loans (SBL Program) can be a great way to finance the purchase of your apartment, multifamily property, or other commercial real estate investment—and we can help!

Loanbase is the leading online platform that provides optimal financing solutions for any investment property or commercial real estate. We’d learn more about your needs and help you determine if an SBL loan is right for you.

Our platform lets you instantly connect with hundreds of lenders to secure the loan that’s best for you. With decades of experience sourcing, vetting, and qualifying relationships, our experienced capital advisors are there for you from lend selection to loan execution.