What is a single purpose entity?

A single purpose entity (SPE) is a borrowing entity which has no other assets or liabilities aside from those which it is being formed to acquire. Lenders who are providing financing for large real estate portfolios and/or commercial real estate transactions typically require the borrowing team forms a single purpose entity?

Why do lenders require investors to form a single purpose entity?

Lenders require the formation of a single purpose entity as it decreases their risk exposure to the borrowers’ assets and liabilities which the lender isn’t providing financing. Single purpose entities limit the lenders risk exposure as real estate investors often have numerous loans and project going on at the same time.

Without a single purpose entity in place

Lender A is now at risk of lender B trying to cash in on the assets owned by the borrowing entity. This now leaves lender A at risk of the assets they lent on being foreclosed. Why? Because the assets are owned by the same entity.

With a single purpose entity in place

Lender B is unable to touch the assets owned by the single purpose entity. The assets that lender A lent on are now safe and face no risk of being foreclosed. Why? Because the assets are owned by a separate entity.

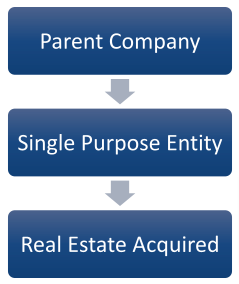

Entity organizational structure

Real estate investors are no stranger to single purpose entities and typically structure their business to be the parent company of numerous single purpose entities.