LoanBase is a CRE lending platform that connects Sponsors and Brokers with the right lenders. We streamline your deal flow by sending only pre-screened, document-ready loan requests that align with your lending criteria.

Each loan request is from a serious borrower, with key documents collected upfront.

We match deals to your specific lending programs, saving you time and ensuring relevance.

LoanBase is completely free for lenders. Our revenue comes from investor subscriptions and brokered deals.

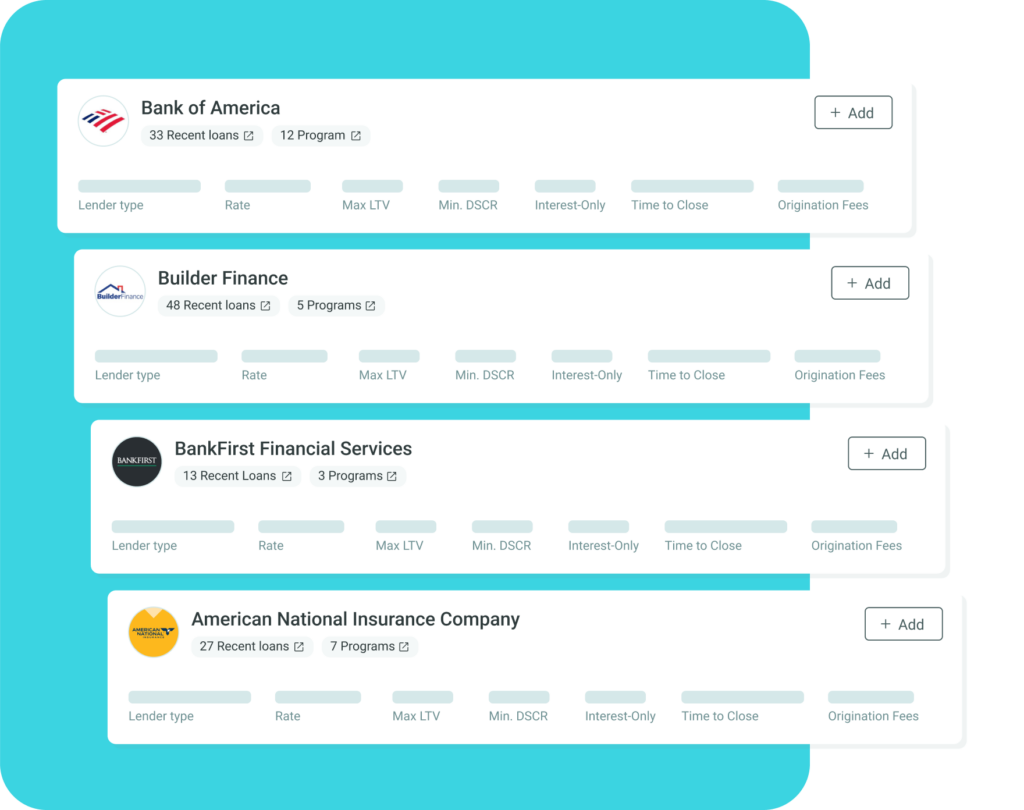

We work with over 4,800 commercial real estate lenders nationwide, and our network continues to grow- typically adding 500 to 1,000 new lenders each quarter.

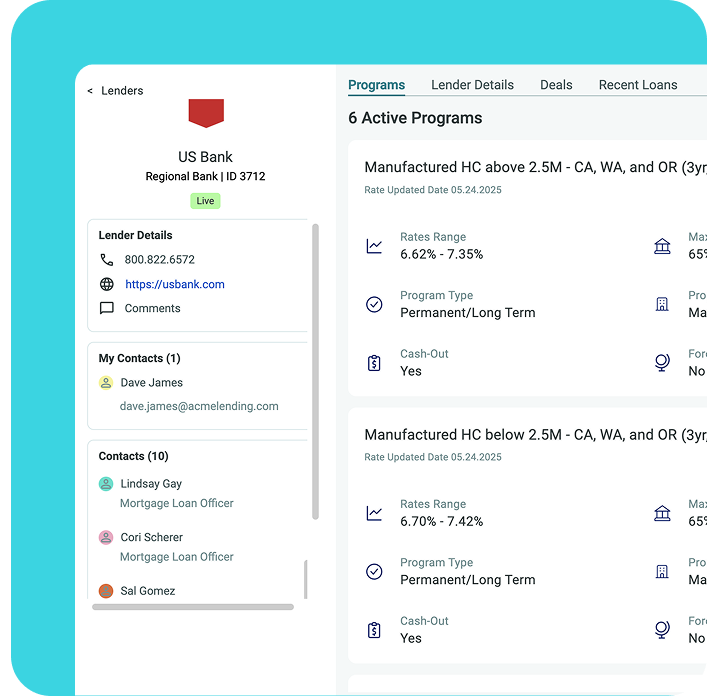

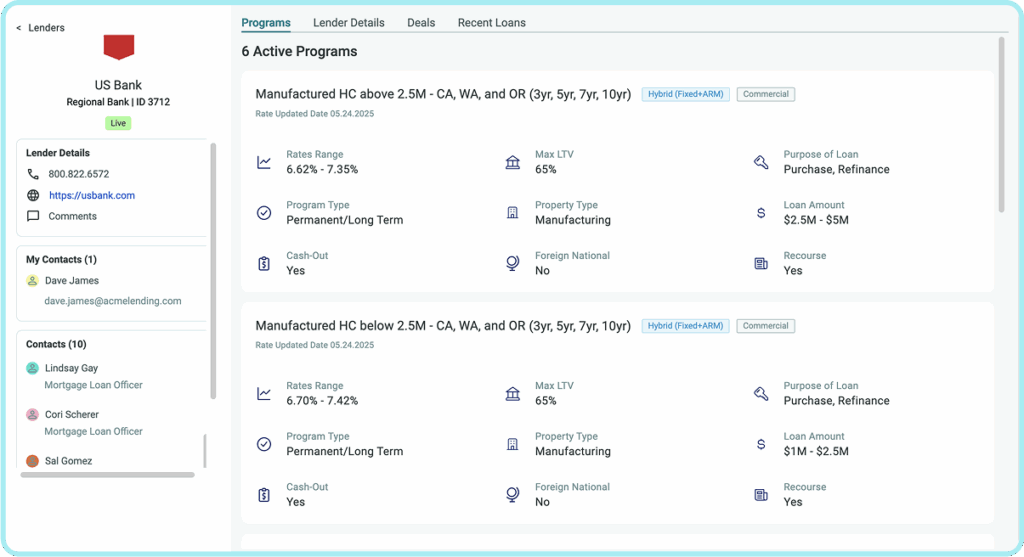

Our Data Team works closely with lenders and reconnects every two months to update lending programs, criteria, and pricing. To get started, we’ll send you a questionnaire and request your latest tear sheet outlining your lending guidelines. The more detail you provide, the higher the chances of receiving high-quality, tailored loan requests.

Our team proactively checks in every two months, but you’re welcome to update your lending profile at any time by contacting our Data Team. Keeping your information current ensures more accurate deal matching.

LoanBase is completely free for lenders. We operate on a subscription model for brokers and investors, with additional revenue coming from successfully brokered transactions.

No. Lenders are not required to log in. To make the process simple, our users- brokers or investors, typically reach out directly by email or phone with loan requests that match your criteria.

We do not offer paid placements or advertise lenders. Visibility is determined by your rates, flexibility, and how well your products align with borrower needs. However, we highlight top quotes and unique offerings in our monthly marketing updates. While users can see matched lenders, only they can view the lender’s name or ID.

Each request submitted to our system is screened and matched to relevant lenders based on your verified products and lending criteria, along with the recent transactions – to make sure you are actively lending on the subject asset type in the market. Our team collects key documents upfront, so the borrower is qualified and ready to move forward when you’re contacted.

Loan requests may come directly from investors or brokers using our system. Investors can use LoanBase on a self-service subscription basis or request assistance from our in-house brokerage team. When brokers are involved, we operate like a traditional intermediary and collect a fee upon closing.

We focus on investment and commercial real estate loans. Most deals in our pipeline involve multifamily (5+ units) and 1- 4 unit residential investment properties. We also see strong volume in retail, industrial, office, and specialized assets like gas stations, EV charging sites, churches, restaurants, funeral homes, affordable housing projects and many more.

Top-performing lenders in major markets with competitive terms typically receive 5-7 qualified loan requests per month. Our marketplace currently sees over 400 active CRE deals monthly.

Since launching our self-service SaaS platform back in April 2025, we’ve grown to over 300 active users. We’re proud to support more than 350 commercial real estate investors and brokers nationwide.

Since our launch, LoanBase has helped close hundreds of commercial real estate loans nationwide. Our platform facilitates millions of dollars in loan volume each month by connecting verified borrowers with the right lenders. In the last quarter alone, users successfully placed over 120 loans through the platform.

At this stage, we don’t offer a lender dashboard, but we’re working on tools to provide more visibility into your deal flow and performance metrics.

LoanBase was founded by Ari Shpanya, a seasoned fintech entrepreneur with a strong background in building scalable platforms. Ari created LoanBase with the vision of simplifying and modernizing commercial real estate financing by connecting investors, brokers, and lenders through technology and data.

© 2025 LoanBase Technologies Inc. All Rights Reserved.