News and Insights > Healthcare construction is leading a boom and cannabis businesses represent a new niche market

The construction sector of the healthcare industry is booming and has never been more critical. With the rising demand for in-patient hospitals, nursing facilities, and medical labs, the need for new construction is growing rapidly. The aging baby boomer generation is driving much of this demand as they strain already outdated and over-burdened facilities, necessitating additional construction.

In response to this tremendous growth in the healthcare industry, new construction projects are popping up all over the country. Construction companies are seeing an influx of projects ranging from standalone medical offices to large hospital complexes, and from small renovations to multi-million dollar ground-up construction.

These high-profile projects have attracted investors from all over the country who see tremendous opportunities for profit within this booming sector. With US national healthcare expenditure reaching $4.3 trillion in 2021 and expected to reach $6.2 trillion by 2028, according to Centers for Medicare and Medicaid Services projections, it is clear that investments into new healthcare infrastructure will continue at a rapid pace indefinitely.

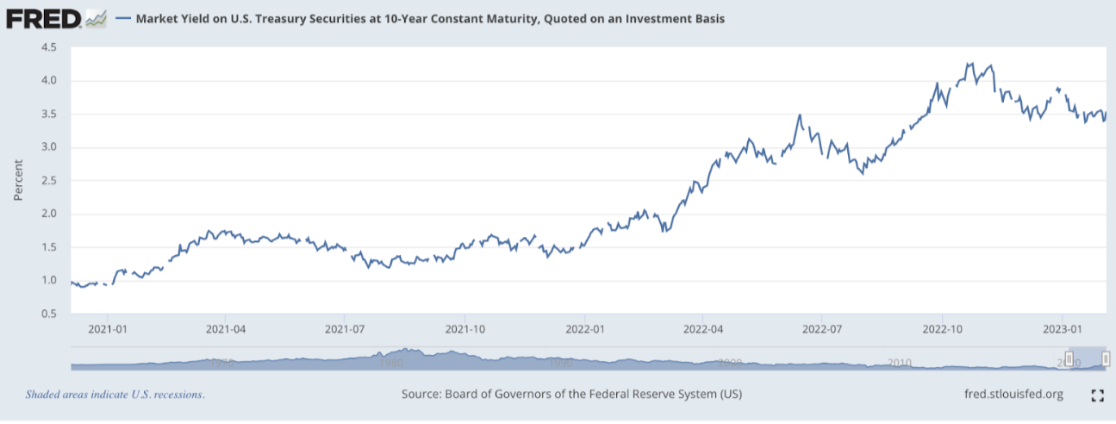

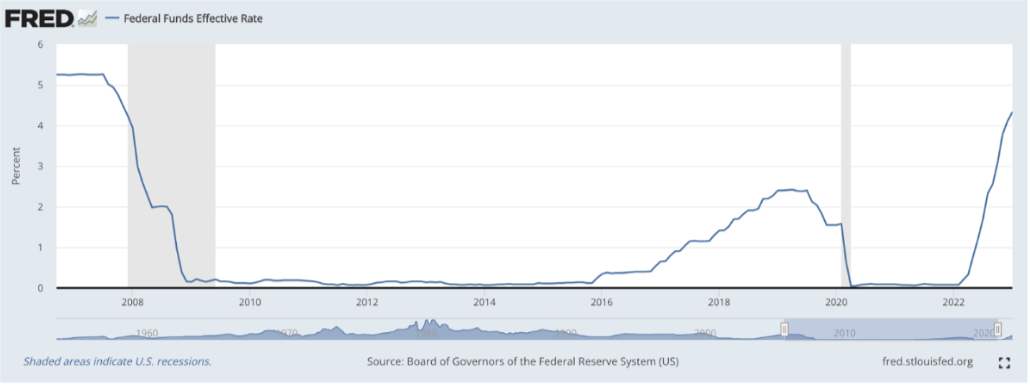

The 10-year Treasury rate, which is often taken as a benchmark for mortgage rates, has seen a surprising reversal in trend this year. In contrast to the Federal Funds Rate, which has been rising rapidly over the past year and currently stands at its highest level in 15 years, the 10-year Treasury rate has actually decreased compared to last year. This means that those considering buying or refinancing their home now have an opportune time to do so, given that mortgages are based on these lower rates.

The decrease in the 10-year Treasury rate can be attributed to several factors, most notably the slowing of economic growth worldwide, leading to investors seeking the relative safety of US government bonds and uncertainty over future Fed policy decisions. Moreover, this decrease has been helped by higher confidence in domestic economic activity, which has allowed long-term borrowing costs to remain low—despite rising short-term rates.

A large part of this increase in confidence is due to a falling unemployment rate, which touched a record low 3.6% earlier this month. At the same time, wages have continued to rise amid a national labor shortage.

In sum, while the Fed Funds Rate remains at its highest level in 15 years and shows no sign of slowing down anytime soon, 10-year Treasury rates have dropped since late last year—offering great savings opportunities for those looking to buy or refinance their home mortgages.

The Federal Reserve’s most recent rate hike of 0.25% was lower than previous rate increases, a sign that the Fed has been taking a more gradual approach to raising interest rates. This is partially due to concerns over rising inflation and the Fed’s dual mandate of maintaining low inflation and full employment.

While other recent hikes have ranged from 0.50% to 0.75%, this latest change was significantly lower than what had been seen previously—signaling that the Fed is actively trying to avoid overly aggressive rate increases that could slow economic growth and potentially send the company into a recession.

The decision for a more modest increase also reflects concerns about global economic uncertainty and risks, such as a slowing housing market and some signs of a coming cooldown in the labor market. Overall, this latest rate increase indicates that the Fed is taking an increasingly cautious approach toward its monetary policy decisions to best promote macroeconomic stability and protect consumer confidence in uncertain times.

Entrepreneurs in the budding cannabis industry—of which there are many—have been paying a premium for real estate due to the lack of property available to them. Zoning restrictions in many areas have made it difficult for cannabis businesses, including cultivators, distributors, and retailers, to operate in certain locations.

This has been further exacerbated by the fact that cannabis has not yet been federally decriminalized, making it virtually impossible for entrepreneurs to qualify for a mortgage using their business revenue or obtain insurance. As such, renting or buying property can represent an additional risk for landlords and other owners of commercial space, which may require additional deposits or higher monthly payments from cannabis business owners.

In many cases, this means that cannabis entrepreneurs pay more upfront just to be able to open their doors—if they are able to get access to property at all—and incur much greater costs than the average business owner over the course of their lease agreement. This can make it challenging for start-ups and small business owners, in particular, to stay afloat in an increasingly competitive industry.

On the other hand, these circumstances have also created a unique opportunity for landlords and investors willing to cater to this niche market.

© 2025 LoanBase Technologies Inc. All Rights Reserved.