The Path to Becoming an Accredited Investor in Real Estate

Real estate has long been a cornerstone of wealth creation and financial stability. For many, it’s a place to call home and a powerful investment

Investment Properties

Real estate has long been a cornerstone of wealth creation and financial stability. For many, it’s a place to call home and a powerful investment

In pursuing property ownership, individuals often face the challenge of purchasing a structure that requires cosmetic or structural improvements. Buying a property that needs repairs

From green investors to seasoned real estate moguls, everyone is looking for strategies to maximize their profits. While some focus on the location, others may

Investing in an apartment complex is a remarkable opportunity for a significant return on investment in the real estate market. Whether you’re a seasoned investor

Investing in real estate can be confusing due to the various strategies and ways to measure success. However, there’s a valuable tool called “Cash on

If you’ve ever thought about investing in real estate, you’ve probably considered residential, commercial multifamily, offices, hotels, or even industrial properties. But what about land

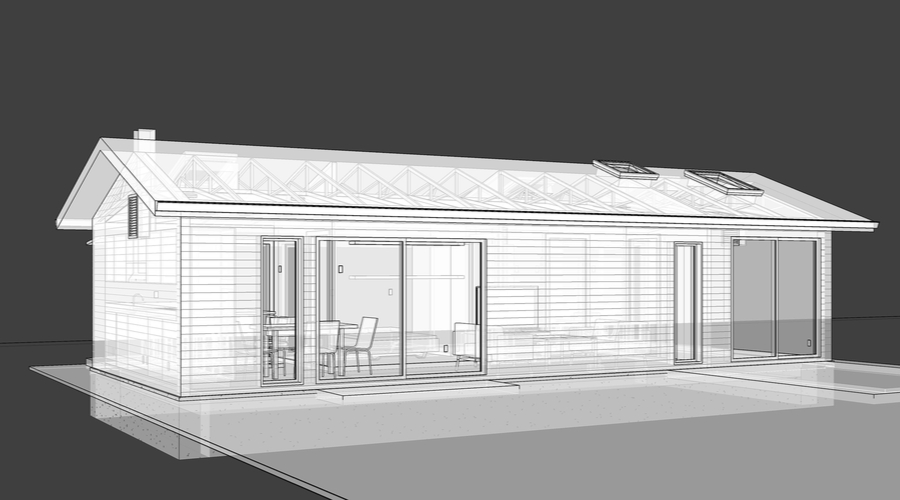

What is an ADU? Accessory dwelling units are secondary dwelling units built on the same lot as your larger, primary residence. They’re a great way

What is a non-owner-occupied investment property? Non-owner-occupied means the owner of the investment property doesn’t live in one of the units nor uses it as

What are multi-unit (2-4 unit) investment properties? Multi-unit investment properties are residential assets with two to four units in a single property. For example, duplexes

What does it mean to fix and flip real estate? The fix and flip strategy has grown exponentially since the 2008 global financial crisis. Investors

© 2025 LoanBase Technologies Inc. All Rights Reserved.