Coverage ratios, whether it’s a debt service coverage ratio (DSCR) or an interest coverage ratio (ICR), measure the ability of an entity to repay its current debt. Commercial lenders use these coverage ratios to determine if a person, project, or business is able to take on additional debt.

If an entity’s coverage ratio is within an acceptable range, additional debt may be extended. If its coverage ratio is too low, loans may either be denied or offered with less than desirable terms.

Four Common Coverage Ratios

There are many types of coverage ratios. The four most common are:

- Debt Service Coverage Ratio (DSCR). This ratio determines if an entity’s profits are enough to cover its debt service, including both principal and interest.

- Interest Coverage Ratio. This ratio determines if an entity’s profits are enough to cover the interest payments on its debts.

- Asset Coverage Ratio. This ratio measures an entity’s ability to cover its debt service by selling off the assets it owns.

- Cash Coverage Ratio. This ratio measures an entity’s ability to cover its debt service using cash on hand.

Regardless of your assets owned and cash on hand, lenders will still need to determine your borrowing ability by calculating either your DSCR or interest coverage ratio.

Let’s take a closer look at these two coverage ratios and see how they affect your borrowing ability.

What is Interest Coverage Ratio?

An interest coverage ratio, sometimes referred to as a times interest earned (TIE) ratio, helps a lender determine how many interest payments you can cover with your current net operating income.

Interest payments can include the interest on your mortgage, business loans, or credit cards. The net operating income part of this equation refers to your income after expenses but before paying interest and taxes. This is usually referred to as earnings before interest and taxes (EBIT).

How To Calculate Interest Coverage Ratios

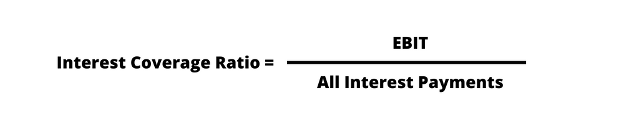

The mathematical formula for calculating your interest coverage ratio is as follows:

To get a better understanding, let’s take a look at a couple of real-world examples.

Interest Coverage Ratio Examples

The higher your interest cover ratio is, the more likely you are to get the financing you need. The following two scenarios help illustrate this fact.

ABC Shipping, Inc.

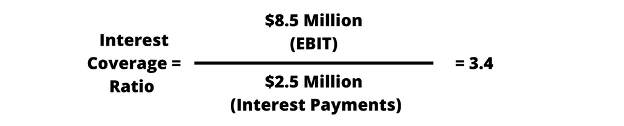

ABC Shipping wants to apply for a construction loan to build a new warehouse. In the first quarter of 2022, the company had a gross income of $10 million. After payroll and expenses that quarter, ABC Shipping had a net operating income of $8.5 million (before interest and taxes).

ABC Shipping has numerous loans, and the interest payments on these loans total $2.5 million per quarter. Using these numbers, we can calculate the interest coverage ratio to determine if they are in a position to take on more debt.

Based on these calculations, ABC Shipping has an interest coverage ratio of 3.4. This means that with its first-quarter net operating income it can cover 3.4 quarters’ worth of interest payments. This puts the company in a very good position to take on more debt.

XYZ Shipping, Inc.

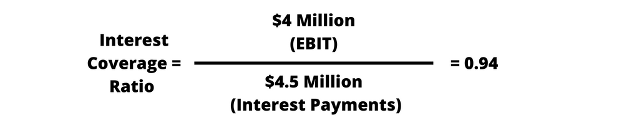

XYZ Shipping would also like to take on more debt to build a new warehouse. In the first quarter of 2022, the company had a gross income of $8 million. After payroll and expenses that quarter, XYZ Shipping had a net operating income of $4 million (before interest and taxes).

XYZ Shipping is deep in debt and pays out $4.5 million per quarter in interest payments. Using these numbers, let’s calculate the interest coverage ratio for XYZ Shipping.

XYZ Shipping isn’t doing well financially. Its net operating income for the quarter falls just shy of its expenses. With an interest coverage ratio of 0.94, it’s unlikely XYZ Shipping will get the financing it’s looking for.

What is DSCR?

Another method lenders use to determine an entity’s solvency is its debt service coverage ratio (DSCR). The difference between an interest coverage ratio and a DSCR is that a DSCR takes into consideration your total debt service. This includes the principal and interest payments made on all debt.

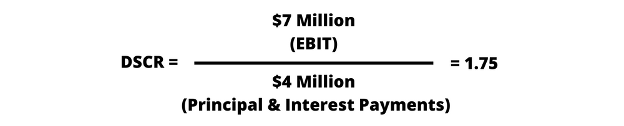

How To Calculate DSCRs

The mathematical formula for calculating your DSCR is as follows:

For a real-world example of calculating DSCR, let’s re-visit ABC and XYZ Shipping a year into the future to see how their finances are doing.

A DSCR Example

The higher a company’s DSCR is, the more likely they are to get the financing they’d prefer. A lower DSCR may not yield the same results.

ABC Shipping, Inc

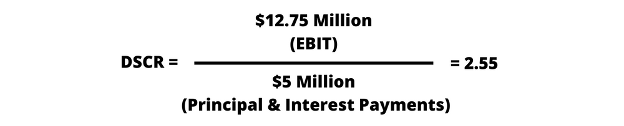

ABC Shipping was approved for its new warehouse loan, and business is booming. In the first quarter of 2023, ABC Shipping has a gross income of $15 million. After payroll and expenses, ABC Shipping has a quarterly net operating income of $12.75 million (before interest and taxes).

ABC Shipping’s total debt service has increased significantly in the past year. In addition to the previous year’s interest payments, it now pays monthly principal and interest payments on its new warehouse loan.

Based on the new and existing loans, ABC Shipping pays out $5 million per quarter in principal and interest payments. Let’s use these new figures to calculate ABC’s DSCR.

A year later, even with additional debt, ABC Shipping is still solvent. With a DSCR of 2.55, it can pay off debt obligations for 2.55 quarters with its current net operating income.

XYZ Shipping, Inc

At the end of the first quarter of 2022, XYZ Shipping took a look at its 0.94 interest coverage ratio and decided to make some changes. A year later, it has expenses under control and has consolidated all of its high-interest loans into a more manageable, low-interest loan.

As a result, its finances a year later look much better. In the first quarter of 2023, XYZ Shipping’s gross income is $9 million. After payroll and expenses, it has a net operating income of $7 million.

After consolidating all of its loans, XYZ Shipping now has a quarterly principal and interest payment of $4 million. Let’s use these new figures to calculate XYZ’s DSCR.

By getting expenses under control and lowering quarterly loan payments, XYZ Shipping has improved its coverage ratio. It’s now experiencing positive cash flow and can pay nearly two quarters’ worth of principal and interest payments with its current net operating income.

By improving its coverage ratio, XYZ Shipping is now in a better position than last year to get financing for its new warehouse.

What Is A Good Interest Coverage Ratio or DSCR?

Whether we’re discussing interest coverage ratios or DSCRs, there’s no specific number that lenders consider a “good” coverage ratio. A ratio of 1 or lower is regarded as a bad coverage ratio. This means that your net operating income is barely covering your expenses.

A good coverage ratio depends on many factors, including:

- The health of the economy. If the economy is slowing down, lenders may increase what they consider a “good” coverage ratio.

- Previous coverage ratios. Lenders will look at previous quarter’s coverage ratios. If your ratios are flat or improving quarter over quarter, lenders may consider a lower coverage ratio of 1.8 good. Conversely, if you have a higher coverage ratio of 2.5, but your coverage ratios are going down every quarter, lenders may be less likely to extend more credit.

- Cash on hand or assets owned. If you’re sitting on a bunch of cash or assets, lenders may consider a lower 1.8 coverage ratio as good. Even if an unforeseen problem arises, you still have enough cash to pay your debts.

While there is no specific coverage ratio that is considered good, lenders like to see a coverage ratio of at least 2. This can go up or down depending and multiple factors.

The Importance of a Coverage Ratio

A properly calculated coverage ratio is important for both the business owner, as well as its lenders.

As a business owner, keeping track of your coverage ratios, over time, is important. It will help you understand if you’re in a position to expand your business, or if financial problems are in the foreseeable future.

As a lender, coverage ratios are a leading indicator of whether or not an entity can meet its current financial obligations.

Pros and Cons of Coverage Ratios

There can be both advantages and disadvantages to coverage ratios. Let’s take a look.

Pros

- It gives the business an overview of how strong its cash flow is, and whether it’s improving or getting worse.

- It gives lenders a good starting point when considering a loan. If a business has a very low coverage ratio, the lender doesn’t have to spend any additional time processing the loan.

- It’s a solid metric for attracting new investors. If you can show potential investors that your coverage ratios are rising yearly, they’re more likely to invest with you.

- It’s easy to calculate and understand. All you need is your quarterly net income and your quarterly loan payments. If the numbers go up over time, you’re in good shape.

Cons

- It doesn’t give a specific picture of your company’s health. If coverage ratios are going down each quarter, the ratio itself doesn’t help you understand why.

- Different lenders calculate coverage ratios differently. Some lenders calculate the net operating income as earnings before interest and taxes (EBIT). Others calculate it as earnings before interest, taxes, depreciation, and amortization (EBITDA), or earnings before interest after taxes (EBIAT).

- As a lender or investor, you can’t just take coverage ratios at face value. Whether intentional or not, coverage ratios can be calculated incorrectly, even over long periods. Even with a high coverage ratio, lenders and investors still need to do due diligence.

Which Is Better: DSCR or Interest Coverage Ratio

If a company’s debt consists solely of interest-only loans, there is no reason to calculate a DSCR. An interest coverage ratio will give you the ratio you need.

If a company’s debt consists of loans that require both principal and interest payments, a DSCR will need to be calculated. In this case, an interest coverage ratio will not accurately reflect a company’s ability to repay its debt.

DSCR and Interest Coverage Ratio as Lender Metrics

Coverage ratios are just one of the many metrics lenders use to evaluate whether or not to extend you new credit. Not only can a low coverage ratio affect your approval, but it can also affect your interest rates, the loan term, and the repayment methods.

Coverage ratios can also affect how lenders take into consideration other metrics. If your credit score is less than perfect, but your coverage ratio is high, year after year, lenders may be willing to overlook the lower credit score.

The same is true for the loan to value (LTV) metric. If your coverage ratio is consistently high, lenders may be more likely to raise their LTV limit, putting more money in your pocket at a better rate.

Getting your coverage ratio as high as possible will yield you the best results when it comes to appealing to potential lenders or investors.